The Dropping Dollar’s Impact on American Students Abroad

“Cool it with the spending” is a phrase many AUP students have heard from their parents since returning to Paris this Fall semester. Ever since the U.S. dollar value dramatically depreciated in comparison to the euro, Americans abroad have had to adjust their spending habits accordingly—goodbye daily lattes, you will be missed!

As an American-accredited university with numerous study abroad partnerships with U.S. schools—some of which include the University of Southern California, Pace University, Vanderbilt University, and George Washington University—Americans make up a large percentage of AUP’s student body. Many of these students are funded by their parents in some way, whether that’s tuition, rent, daily living expenses, or all of the above. In the past, the dollar has been relatively close to being equal to the euro; this is no longer the case.

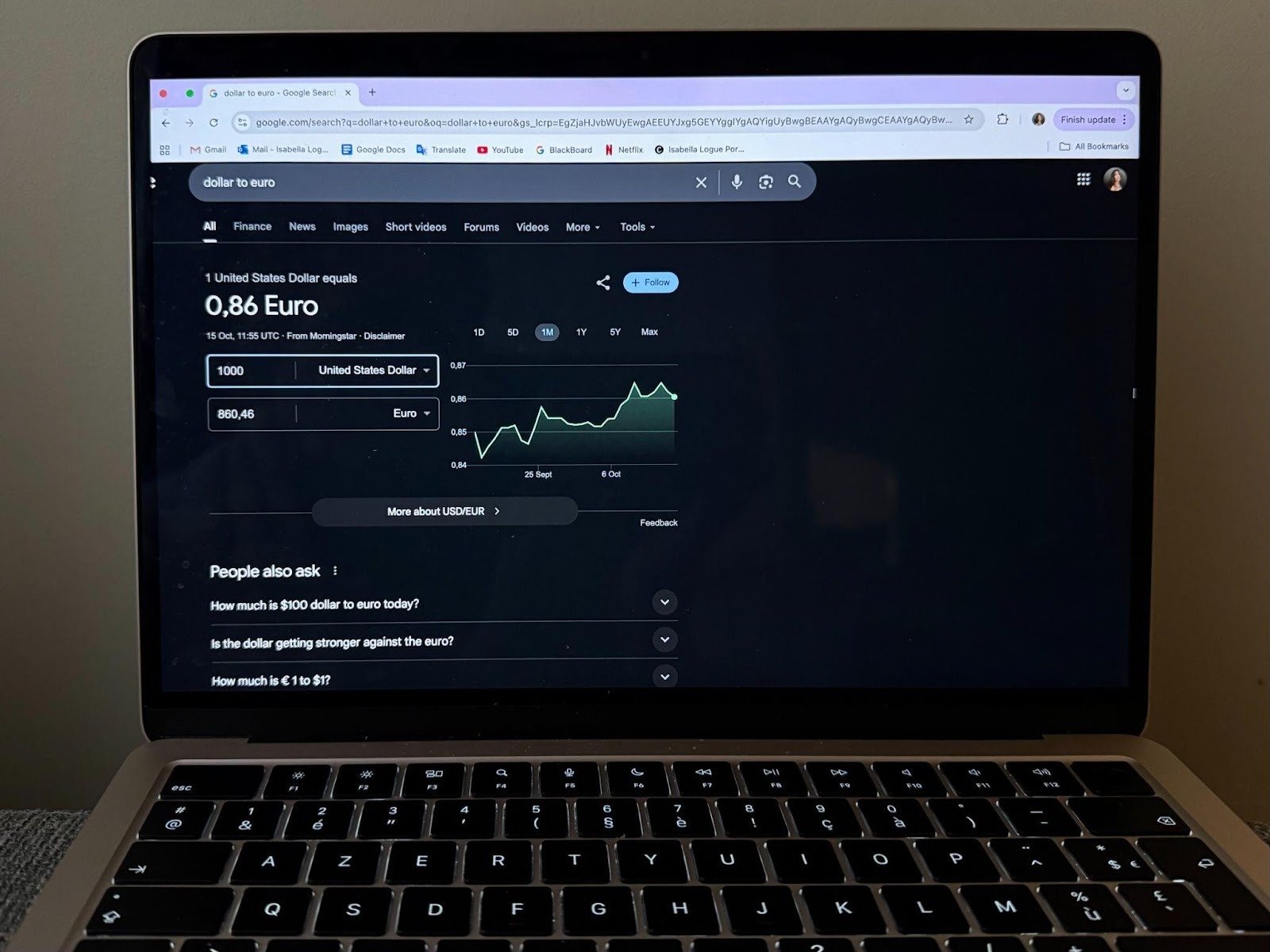

The U.S. dollar has dropped about 11% in 2025, which marks the biggest decline in over 50 years, the last time being when President Nixon detached the dollar’s value from gold in 1973. We have President Trump to thank for today’s dollar drop, which is a result of his new tariffs and attack on the Federal Reserve that created a lack of confidence in many U.S. investors across the globe.

Image credit: Isabella Logue

This drastic change makes living in Paris and paying euro-based tuition and rent significantly more expensive for all U.S. dollar-funded students.

Rita Duggan, a Senior at AUP, explains how her daily life has been affected by the dollar decline, saying, “My parents live in the U.S., and my life here is funded through U.S. federal student loans, so my budget is tied to the dollar. Each semester, I get the amount I am eligible for, and I budget that to last me throughout the year for rent, groceries, and other living costs.” The conversion from United States federally-granted financial aid to AUP’s euro-based tuition has resulted in less coverage, which forces students like Duggan to make up for this shift in daily expenses.

AUP Senior, Erin Gray, had a similar experience with her tuition payment this semester, which was allegedly raised by 7% for all students. Gray remarks that she tried to soothe this increase, stating, “I resubmitted my FAFSA to receive increased financial aid to match the tuition increase, but AUP declined my request, claiming that ‘they had no money to give me.’” The university’s response to Gray is questionable—if not downright untrue—especially when considering the recent Amex and atrium remodels and additional campus extensions that they have been advertising this year, both of which have garnered opinionated responses from students who believe the changes were unnecessary and an irresponsible use of the school’s (apparently very limited) budget.

Duggan further elaborates on her situation, explaining, “My financial aid from AUP is calculated as a percentage of my tuition, so it doesn’t change when the dollar fluctuates. This semester, the dollar was about 10% weaker than last semester, so although my loan remains the same in the U.S., it is significantly less after converting it into euros. I end up with less money for daily expenses despite my budget staying the same. Exchange rate shifts make a real difference, and I’ve been more conscious of budgeting and how living abroad affects things.”

One of AUP’s biggest draws for prospective students is its central location in the heart of Europe. Hundreds of cities are just a short train ride or flight away, and the university’s study trips offer easy access to guided trips. However, this is another aspect hindered by the dollar drop. Dugan says, “Like a lot of AUP students, I used to take advantage of breaks to travel around Europe, but now I’m staying put more often. As for saving money in Paris, I try to stick to local markets for groceries and take advantage of student discounts with websites like Student Beans when possible.”

It’s not just the big expenses like tuition, rent, and Navigo subscriptions that are taking a hit to students' bank accounts. Groceries, cafes, and small daily purchases are also having an impact, forcing AUP students to adjust how they spend their free time.

Image credit: Isabella Logue

Gray tries to save money by maintaining some structure to her free days and outings with friends—after all, spontaneity often leads to last-minute splurges. “I recommend having plans because when you’re spontaneous, that's usually when you accidentally spend a lot of money. I think having some sort of structure when you hang out with your friends helps you maintain a budget and save money. If you both plan ahead, it'll be more financially rewarding. When you think ahead, you realize that there are always free things to do. Instead of spending €20 at a restaurant, pack a lunch and sit by the Seine. Studying at free libraries or co-working spaces is a great way to get work done without having to buy overpriced lattes. Even dedicating a space or corner in your apartment to just studying will allow you to focus at home, rather than having to leave the house to be productive,” suggests Gray.

Though it doesn’t seem like the dollar will be catching up to the euro any time soon, there are plenty of ways to make small adjustments to daily living that minimize your losses. You never know, by cutting out your daily beverage purchases, you may just discover your new talent for latte art!