Is Black Female Higher Education Undervalued In The US?

Ever since I was a little girl, I dreamt of being a lawyer. At 10, I wanted to work for the United Nations. At 18, I wanted to work for the American Civil Liberties Union. I am currently in my first semester of a year-long graduate program at AUP, which will cost me roughly $72,000, including living expenses. My undergraduate degree was about $52,000, and I have around $45,000 in federal student loans. The Biden-Harris administration has created a loan repayment scheme that will provide Americans with a minimum of $10,000 and a maximum of $20,000 towards federal loan repayment. However, the Biden-Harris administration did not consider the student loan debt accrued by women of color, like myself, who are the most educated and underpaid population in the United States of America. More should be done. The Biden-Harris administration’s one-time student loan forgiveness is another example of systemic racism, sexism, and ageism due to its failure to consider the nuances of the educated population of all Americans.

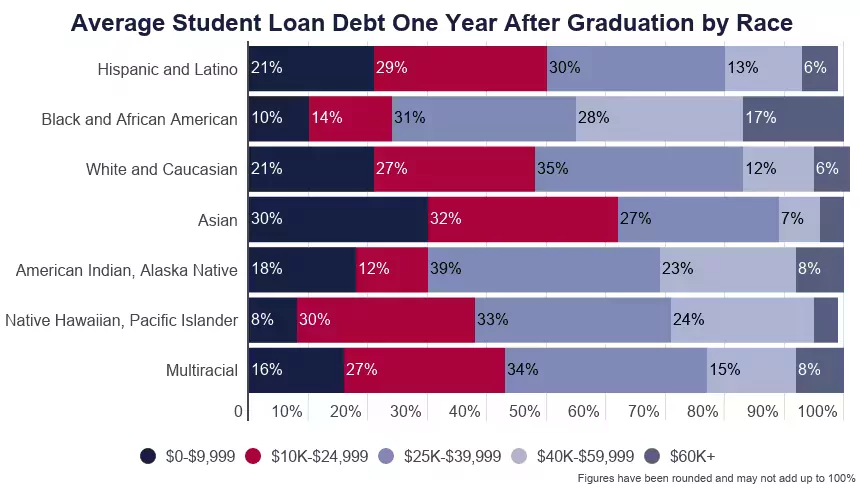

According to the National Center for Educational Statistics, Black women are the most educated population in The United States of America, followed closely by Latinas. Similarly, the most underpaid grouping of people in the workforce, based on race and gender, are Black women and Latinas. Despite being the most educated in the country, by measure of higher educational degrees, Black and Latina women make the least money and statistically have the most educational debt. The One-Time Federal Student Loan Debt Relief Program provides a $10,000 loan forgiveness for federal student loan borrowers, with an additional $10,000 granted to borrowers who also received Pell Grants as undergraduate students. The Biden-Harris administration is trying to find a way to overhaul and change student loan debt repayment.

Image credit: EducationData.Org/ Melanie Hanson

Black women have more educational debt than any other American due to their high-achieving academic pursuits. Although there has been a pause on student loan repayments and interest since the pandemic, women who received loans before the break two years ago have been paying interest and the principal amount of the loan. Black and Latina women of a certain age have endured interest payments on top of loan repayments with an average salary of $43,000 a year. They have an average of $42,000 monthly accrued interest in student loans but are offered $10,000 of student loan forgiveness.

Image credit: WikimediaCommons

My dream of becoming a lawyer seems increasingly unattainable with every interest charge, which will resume along with payments in January 2023. I learned to shoot for the moon and land among the stars. Even though the stars seem unattainable, I don’t plan on letting my crippling debt interrupt my altruistic pursuits. However, my future looks bleak; law school, on average, is about $85,000, not including room and board. I will leave AUP with over $65,000 in federal student loans, with a future of about $100,000 more in student loans for law school.

Lulu Stones, a Brazilian Latina, also in her first semester as a graduate student at AUP, understands the struggle and expense of higher education. She will have amassed around $90,000 in federal student loan debt at graduation. Similarly, she feels skeptical about student loan forgiveness. “At this point, I don’t buy into all the benefits of the loan forgiveness plan because a lot of my experiences when applying for loans and scholarships that are ‘made for me’ don’t benefit me like they say they will.”

Even though this academic forgiveness plan could be better, it is a step in the right direction. As a Black woman, I have always felt like my starting line began miles ahead of everyone else’s, and my finish line keeps fading in the distance. However, I won’t let the hardships deter me, nor should you! According to FederalStudentAid.gov, the student loan forgiveness program will automatically apply to your account on November 14, 2022, if you are eligible. If you would like to be proactive, the plan is now available for applications.

*This article was written before any blocks made by ongoing court cases. Applications are currently halted, but you can subscribe here and check for updates.