Trump's Right: U.S.-China Trade Relationship is Imbalanced

It has been more than 100 days since the United States started imposing billions of dollars of tariffs on Chinese goods, with China responding on an equal scale against U.S. products. In September, Trump tweeted "Tariffs have put the U.S. in a very strong bargaining position, with billions of dollars, and jobs, flowing into our country and yet cost increases have thus far been almost unnoticeable. If countries will not make fair deals with us, they will be "Tariffed!" The Trump administration, led by “America First” policy, hopes to reduce imports, increase exports, and improve its international balance of payments through trade protectionism.

Economists have argued that a trade war between the world’s largest economies would create extreme consequences for the globe. However, the Trump administration is not wrong to question the current U.S.-China trade relationship. The basic premise of the argument is that continuous economic integration with China is no longer benefiting the United States. In 2001 when the United States welcomed China in the World Trade Organization (WTO) , it was believed by advisors in Washington that a richer China would soon become a more democratic and peaceful China.

Unfortunately, 16 years after joining the WTO, China has become richer and is still no closer to becoming a democracy. Beijing has used its wealth to pay for sophisticated military build-ups, extend its influence into Europe and Africa, and is using geopolitics to challenge the Western dominated world order. Furthermore, Beijing has aggressively targeted the U.S. manufacturing base as part of an effort to build its own domestic enterprises, subsidies and other protectionist approaches to reach supremacy in high-tech sectors, including national security and defense.

Another point of contention is China’s exchange rate policies China has previously endeavored to weaken their currency, the RMB, to maintain a competitive advantage for its exports, but since 2015, with economic growth slowing, the country has shifted to propping up the currency instead. Moreover, as a 2014 report from the Economic Policy Institute argued, the surge in Chinese imports lowered wages for non-college-educated workers and cost the United States 3.4 million jobs since 2001.

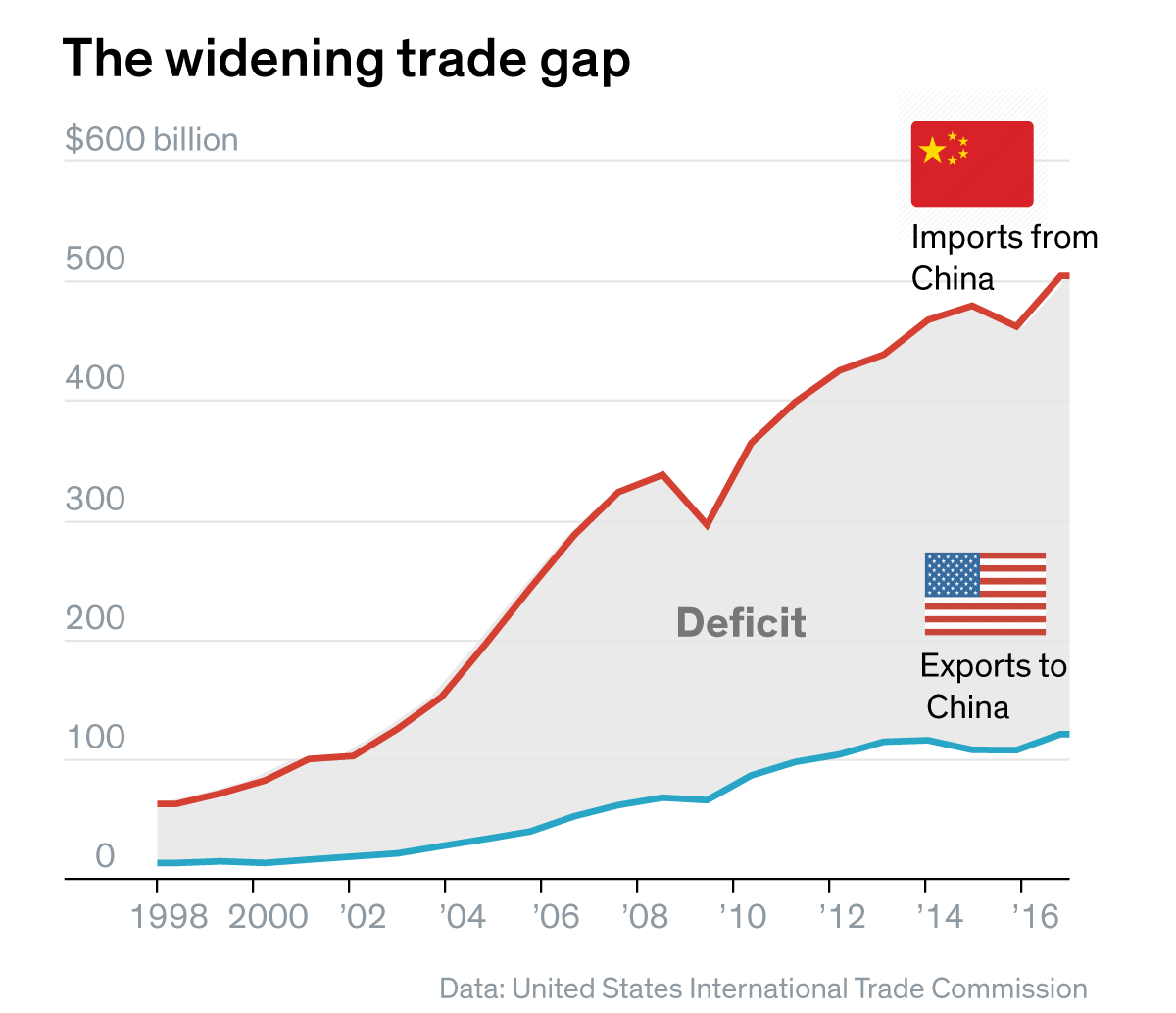

What is the US Trade Deficit?

A trade deficit occurs when a nation imports more than it exports. For instance in 2016, exports to the United States were $389.7 billion, about 20 percent of China’s exports. In contrast, China only imported $135.6 billion in 2016 from the United States, about 10 percent of China’s imports. The U.S. trade deficit has risen from 0.8 percent of GDP in 2000 to 2 percent of GDP in 2016.

Image Credit: United States International Trade Commission

Services, such as tourism, intellectual property, and finance, make up roughly one third of U.S. exports. Major U.S. goods exported include aircraft, medical equipment, refined petroleum and agricultural commodities. Meanwhile, Chinese imports are dominated by capital goods, such as computers and telecom equipment; consumer goods, such as apparel, electronic devices, and automobiles; and crude oil. (The deficit in goods, at $750 billion, is higher than the overall deficit, since a portion of the goods deficit is offset by the surplus in services trade.) As Harvard’s Martin Feldstein explains, the fundamental cause of the trade deficit can be boiled down to the United States as a whole spending more money than it makes, which results in a current account deficit.

Here is where President Trump can make some positive contributions. On the domestic realm, the Trump administration must address the excessive spending in the United States. As the International Monetary Fund has pointed out , one of the most direct ways to do that is to reduce the government budget deficit. Yet this may be unlikely, given that Trump’s budget proposal includes higher defense and stimulus spending, and a tax reform plan is likely to increase the budget deficit.

On the international realm, President Trump should negotiate better access to Chinese consumers. The United States’ most important sectors are finance, social media, telecommunications, health care and transportation. They are also largely closed to imports and foreign investment. Although there has been little progress, opening China’s markets would offer more choices to its own consumers and would help maintain a stable relationship with the United States.

With the rise of China, President Trump has started a conversation that the United States must have: how will Washington manage its finances? What type of relationship should the United States have with China? In order to improve the United States' economy and its relationship with China, the Trump administration must work with its allies, for trade imbalances are a global issue. Tariffs are not the answer, but it is at least a starting point. The question going forth: what will Trump do now that he has China’s attention?